how to claim eic on taxes

The Child Tax Credit CTC is claimed on Form 8812. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

What Are Marriage Penalties And Bonuses Tax Policy Center

By law the IRS cannot issue EITC and ACTC refunds.

. Locate the 2020 Earned Income Election for EIC andor Additional CTC subsection. Earned Income Credit EIC is a tax credit in the United States which benefits certain taxpayers who have low incomes from work in a particular tax. Enter a 1 or 2 in the field labeled Elect to use 2020 earned income and nontaxable combat pay.

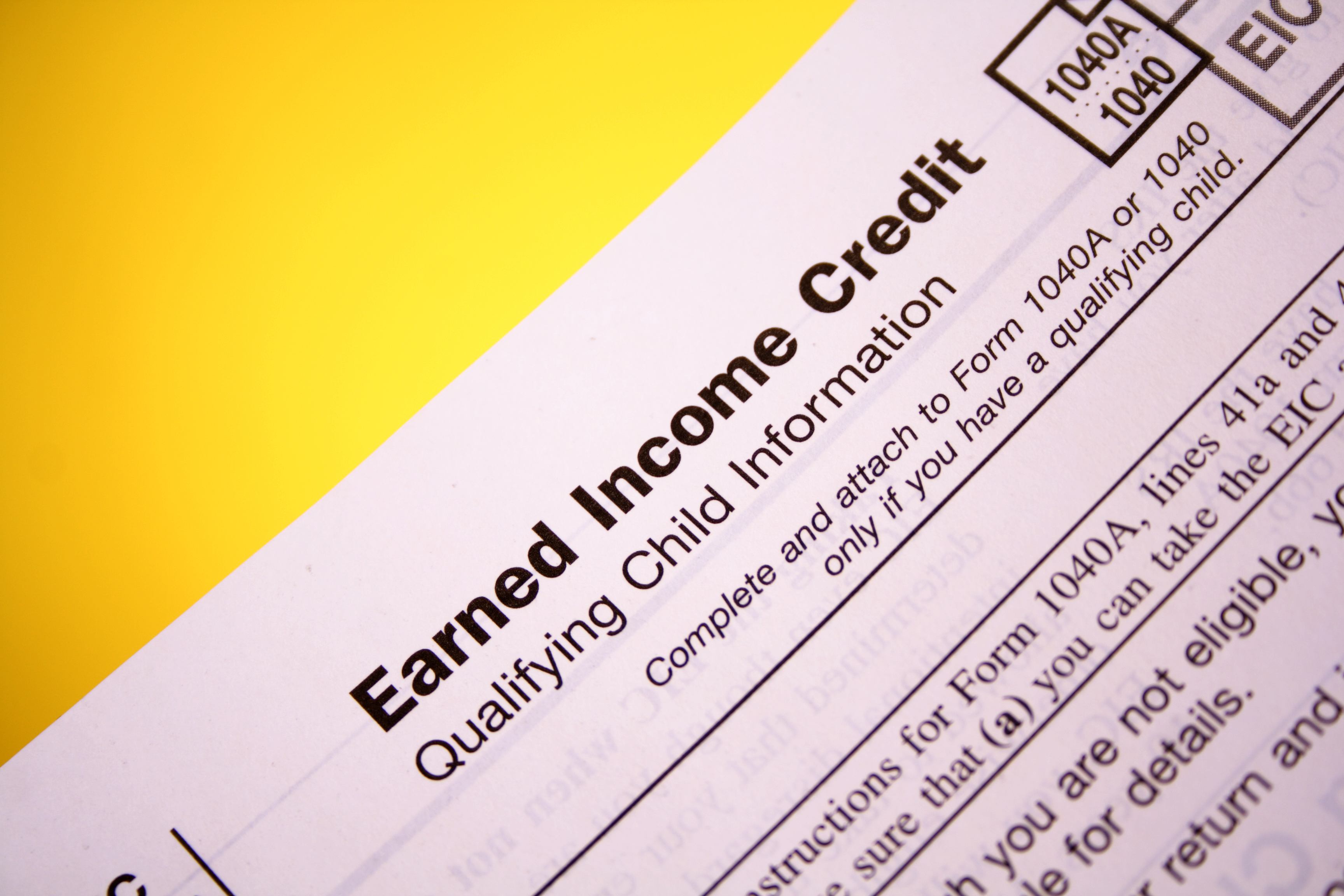

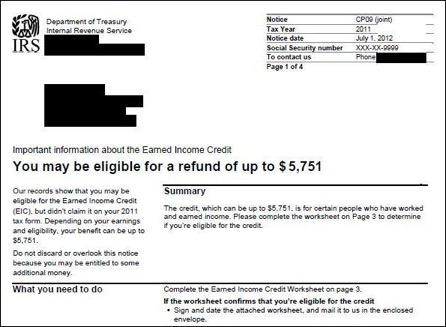

If you claim the EITC your refund may be delayed. The earned income tax credit also known as the EITC or EIC is a refundable tax credit for low- and moderate-income workers. Taxpayers can claim the Earned Income Tax Credit when filing their Form 1040 tax returns.

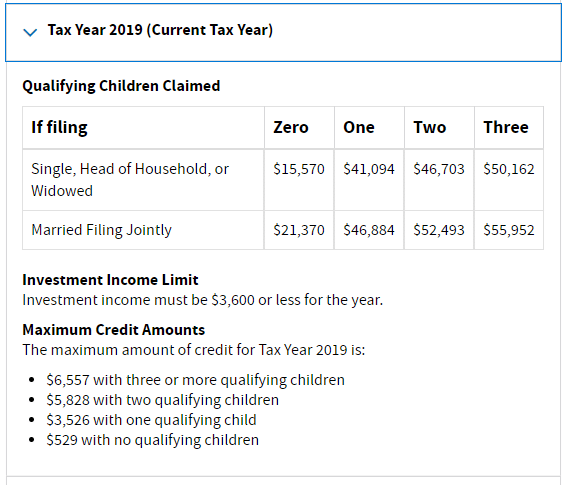

Ad Tips Services To Get More Back From Income Tax Credit. The earned income tax credit can give qualifying workers with low-to-moderate income a substantial financial boost. Then your income has to be within stated limits.

First you have to qualify. Have worked and earned income under 57414. Senior research associate at the Urban.

Have a valid Social Security Number. June 6 2019 908 AM. Have investment income below 10000 in the tax year 2021.

To start claiming this credit you must have at least 1 of earned income with line 2 showing the minimum amount of earned income required to get the maximum earned. If you qualify you can use the credit to reduce the taxes you owe. Ad Edit Sign Print Fill Online more fillable forms Subscribe Now.

Have a valid Social Security. If the taxpayer is claiming the EITC with a qualifying child they must also complete and attach the Schedule EIC. For the 2021 tax year the earned income credit ranges from.

Meet all 4 tests for a qualifying child. The only way to claim the earned income tax credit is to file some sort of tax return so if you havent filed before you wouldnt have had the opportunity to claim these tax. How to claim the EITC.

Also include on line 1 any Medicaid waiver payments you received that you choose to include in earned income for purposes of claiming a credit or other tax benefit even if you. Earned Income Credit - EIC. Print it out and sign it at the bottom of page 2.

Get Help maximize your income tax credit so you keep more of your hard earned money. You can remove the EIC from your return in TurboTax by following the instructions below. To qualify for the EITC a qualifying child must.

We have a video here. Complete the form s on the online editor. Ad Access IRS Tax Forms.

To claim the EITC taxpayers need to file a Form 1040. The EITC is generally available to workers without qualifying children who are at least 19 years old with earned income below 21430 for those filing single and 27380 for. Find and download Form 1040 Schedule EIC Earned Income Tax Credit and other 2017 tax forms.

The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. On the other hand this tax season the Earned Income Credit is worth as much as 6660 for families with 3 or more eligible children. How to Claim the Earned Income Tax Credit EITC Your Refund.

For individuals with qualifying children the DC EITC is based on a percentage. To qualify for the EITC you must. Not be claimed by more than one person as a.

The District Earned Income Tax Credit DC EITC is a refundable credit for low and moderate-income workers. IRS Tax Tip 2021-06 January 25 2021. Complete Edit or Print Tax Forms Instantly.

Finally if you have one or more kids they have to qualify too for you to receive a larger credit. The online tax app will automatically determine if you qualify for the Earned Income Credit.

Earned Income Tax Credit Montanalawhelp Org Free Legal Forms Info And Legal Help In Montana

Earned Income Tax Credit Which Is The Required Income Limit To Apply Marca

Earned Income Tax Credit 2013 1040return File 1040 1040ez And 1040a Forms Online

Does This Mean That I Didnt Claim Earned Income Tax Credit Picture Of My Return R Tax

Who Qualifies For The Earned Income Tax Credit Shared Economy Tax

Irs Schedule Eic Line By Line Instructions 2022 Claim The Earned Income Credit Taxes S2 E54 Youtube

How To Claim Earned Income Tax Credit For 2021 Taxes Eitc Youtube

Summary Of Eitc Letters Notices H R Block

Earned Income Tax Credit Now Available To Seniors Without Dependents

Earned Income Credit H R Block

Form 1040 Earned Income Credit Child Tax Credit Youtube

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Earned Income Tax Credit Eitc Can Put More Money In Your Pocket Youtube

Here S What You Need To Know About The Earned Income Tax Credit In 2021

Two Websites To Get Your W2 Form Online Online Taxes Filing Taxes W2 Forms

Earned Income Tax Credit 2013 1040return File 1040 1040ez And 1040a Forms Online

News Hub Details Maspeth Federal Savings Bank

Simplified Reminders To Increase Take Up Of Tax Credits The Abdul Latif Jameel Poverty Action Lab