child tax credit october 15 2021

In terms of monthly payments families will receive their check for 300 for each child under 6 years old. Parents with dependents between 18 and 24.

Irs Makes First Payments Of Advanced Child Tax Credit On July 15 Wfmynews2 Com

Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021.

. The credit enabled most working families to claim 3000 per child under 18 years of age and 3600 per child six and younger. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. A new payment of the child tax credit will begin to reach the bank accounts of millions of eligible families in the United States today October 15 The Sun reported.

1200 sent in April 2020. 1200 sent in April 2020. The IRS website provides additional information to confirm if citizens are eligible for the tax.

The Child Tax Credit provides monthly payments to families even those who do not file taxes or earn an income. Checks will be sent out from October 15 and should arrive in bank accounts within days. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021.

Thats an increase from the regular child tax. Of families will receive 3000 per child ages 6-17 years old and 3600 per. Child tax credit payments worth up to 300 will be deposited from October 15 Credit.

Have been a US. Millions of families should soon receive their fourth enhanced child tax credit payment which the Internal Revenue Service distributed on Friday. Under the American Rescue Plan the maximum child tax credit rose to 3000 from 2000 per child for children ages 6 and older and it rose to 3600 from 2000 for children.

Enhanced child tax credit. The fourth monthly payment will go out on October 15 so you should expect to receive either 300 or 250 dollars depending on your personal situation. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now.

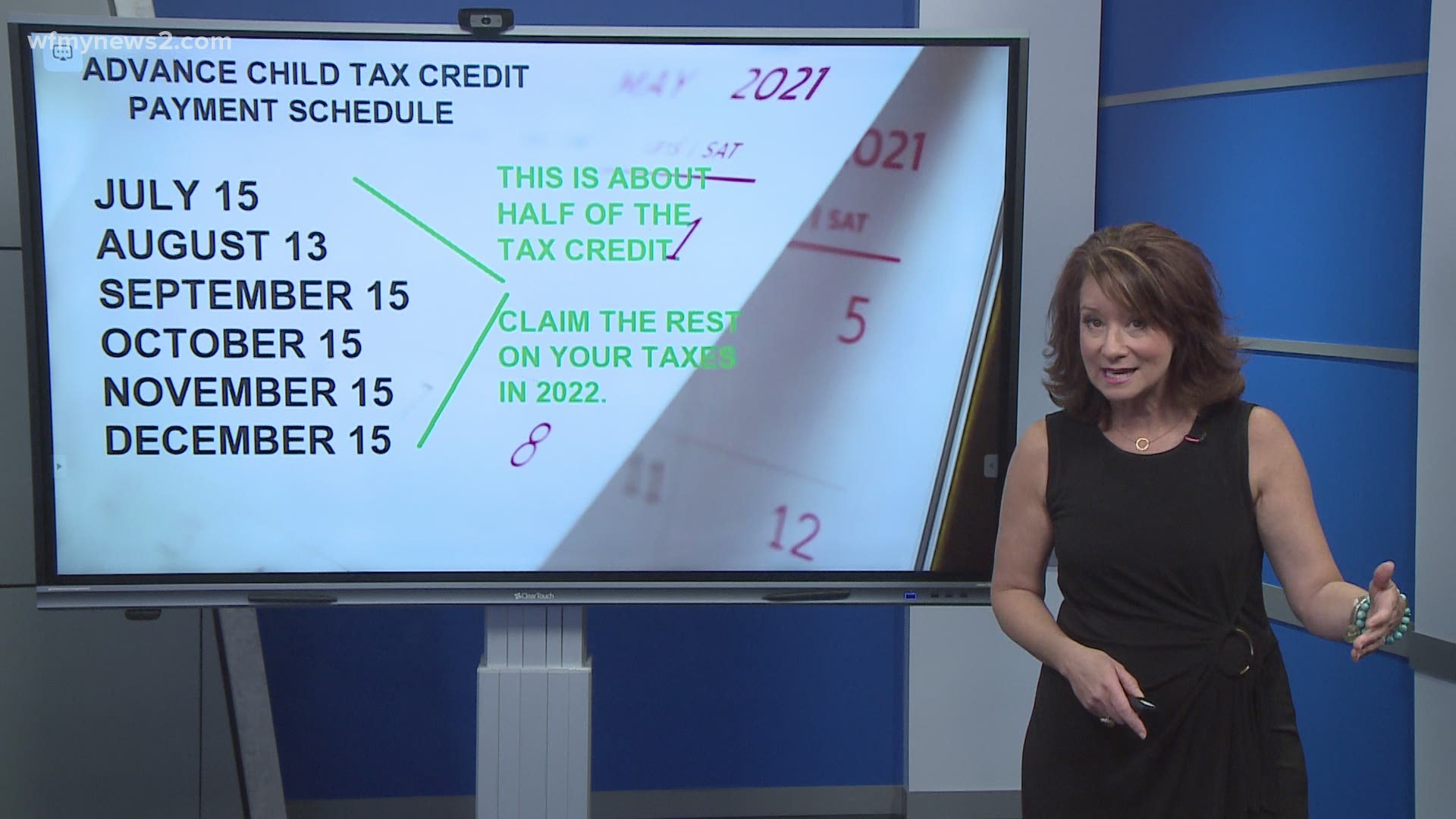

Heres how the child tax credit works. IR-2021-201 October 15 2021. Families that filed their tax returns before July will receive six payments worth.

The credit tops out at 3000 for children between 6 and 17 years old. The child tax credit scheme was expanded to 3600 from 2000 earlier this year. Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021.

For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks through the mail anywhere from a few days to. More than 15 billion. Families are slated to receive 3600 for each child under the age of 6 and 3000 for each child between the ages of 6 and 17.

Enhanced child tax credit. October 15 2021 142 PM CBS Detroit. The next child tax credit payment will be issued on October 15 2021.

Individuals whose incomes are below 12500 and couples below 25000 may be able to file a simple tax return in as little as 15 minutes the IRS said on the website. CBS Detroit -- The Internal Revenue Service IRS sent out the fourth round advance Child Tax Credit payments on October 15. All eligible families could receive the full credit if they.

It is worth remembering. Normally you get the Child Tax Credit when you file your tax return youd get the 2021 credit in the spring of 2022 when you file your 2021.

You May Be Surprised By Cuts In October Child Tax Credit

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

October Child Tax Credits Issued Irs Gives Update On Payment Delays

It S October 15th You Know Ways And Means Committee Facebook

Rep Ritchie Torres On Twitter Families In The Bronx And Across The Country Will Receive A Fourth Round Of Childtaxcredit Payments Beginning Today Nearly 98 Of Children In Ny15 Will Gain From

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

File Your Taxes Access Community Action Agency

Child Tax Credit More Than 15 Billion In Payments Distributed On Friday Cnn Politics

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

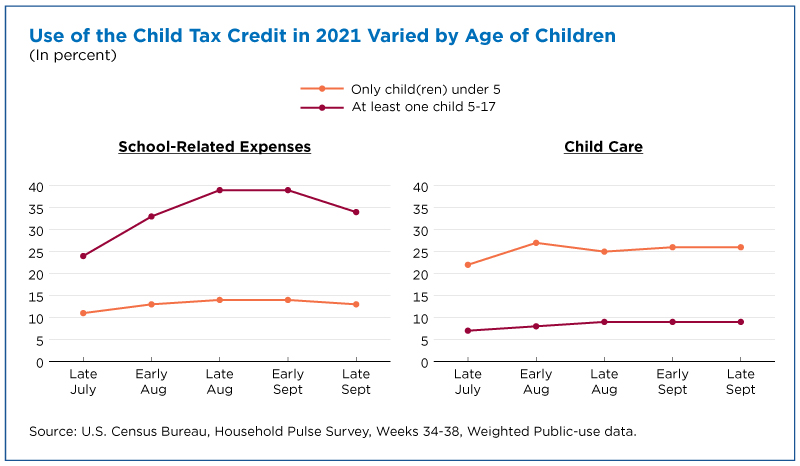

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

Child Tax Credit 2021 What To Know About New Advance Payments

Revised Child Tax Credit Everything You Need To Know Ramsey

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time

Parents Can Still Claim Their Expanded Child Tax Credit By Nov 15 2022 Here S How

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Stimulus Update Here S When To Expect October Child Tax Credit Payment Silive Com

Using The Child Tax Credit To Boost Your Banking

Child Tax Credit 2021 8 Things You Need To Know District Capital

November 15 2021 Deadline For Non Tax Filing Families To Use Child Tax Credit Portal Lone Star Legal Aid